Every Statistic Tells A Different Story!

8th Ocrtober 2014

Spain has become the only European country with improved economic prospects for 2015, according to the International Monetary Fund.

The Washington-based IMF has announced that Spain’s economy will grow by 1.3% in 2014 and by 1.7% in 2015, up from July’s forecasts of 1.2% growth this year and 1.6% growth next year.

This is the fastest predicted growth of any advanced European economy, despite a public debt of nearly 100% of GDP, a 25% unemployment rate and no alternative to construction as an engine of growth.

“Growth in Spain has resumed, supported by external demand as well as higher domestic demand reflecting improved financial conditions and rising confidence,” according to the IMF report.

Spain has been recording gradual gains over the last 12 months, driven first by exports and later by increased consumption, in turn encouraged by job creation.

Across the Eurozone, growth forecasts have fallen to 0.8% for 2014 and 1.3% in 2015, down from July’s forecast of 1.1% for this year and 1.5% for next.

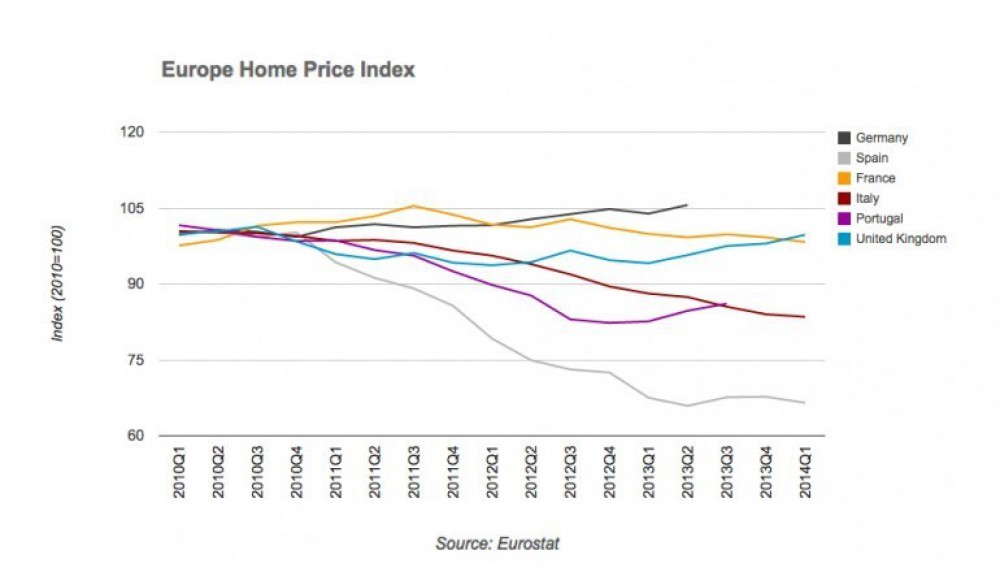

During August and September 2014 various positive signs of recovery have been reported. Credit rating agency Fitch assured that the residential market ‘ is showing traces of stabilization‘ and the National Institute of Statistics confirmed the 1st rise in prices of free housing since 2008. Year-to-date, the values rose by 1.4%.

On one hand, the demand soars up in various segments, such as residential rentals, logistics and offices, as well as in construction.

-

Rental market and its prices started to take-off, the number of homes for rent is 42.5% greater than three years ago.

-

There has been a 48% improvement in the entire logistics space demanded in the second quarter of 2014.

-

The office market regains the shine in Barcelona and Madrid with investment volume in the first half of 2014 amounting to €275 million.

-

Eurostats suggest that Spain takes the lead in construction with a nearly 7% growth measured from April to June. In addition, from January to August the City Council of Madrid has issued 35% more new home construction permits than the same period last year.

In terms of transactions, the most significant operations were: Sareb´s sale of 23-loan “Pamela” portfolio with a face value of €198.2 million, TH´s purchase of the Islazul shopping mall for €210 million, the Government Pension Fund of Norway´s acquisition of several logistics assets in Madrid and Barcelona for €242 million in total and Jove & Partners´s transfer of the Marineda City shopping park to Merlin Properties for €260 million.

Operations coming soon: KKR and Neinver have set up a joint venture with view to acquiring the Nassica and the Vista Alegre shopping malls from Pilar Retail European Fund. Quabit is planning to list its Socimi (Spanish Reit firm) on the stock exchange market via a public offering for subscription (POS) estimated at between €400 and 500 million.

Popular posts